Form 1040 Schedule Se 2024 Download – Peter managed reviews and listings for Download.com your lender in early 2024. You can then enter the amount from Line 1 on that Form 1098 into Line 8 of 1040 Schedule A. . Here are our top picks for 2024 as wages or self-employment income determines how you should report it. Employees would report cryptocurrency as wages on line 1 of Form 1040, while self .

Form 1040 Schedule Se 2024 Download

Source : sites.google.comFederal Income Tax Spreadsheet Form 1040 (Excel Spreadsheet

Source : sites.google.comSchedule se: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 1040 schedule se: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Schedule SE (1040 form) | pdfFiller

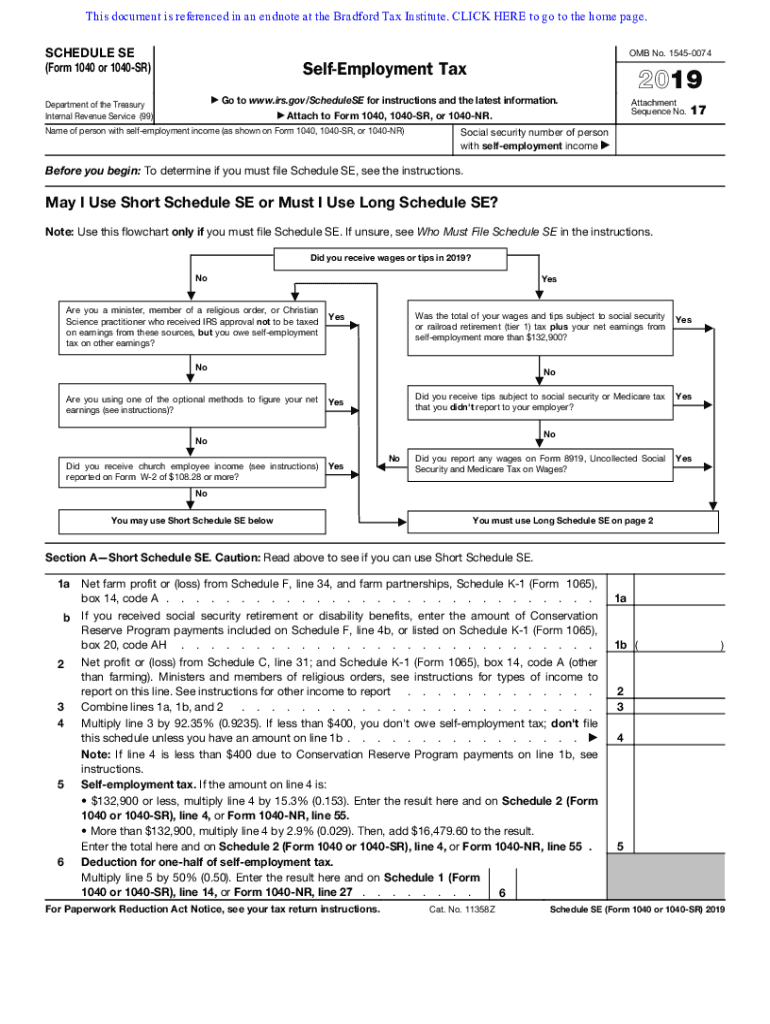

Source : www.pdffiller.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.govSchedule SE Self Employment (Form 1040) Tax return preparation

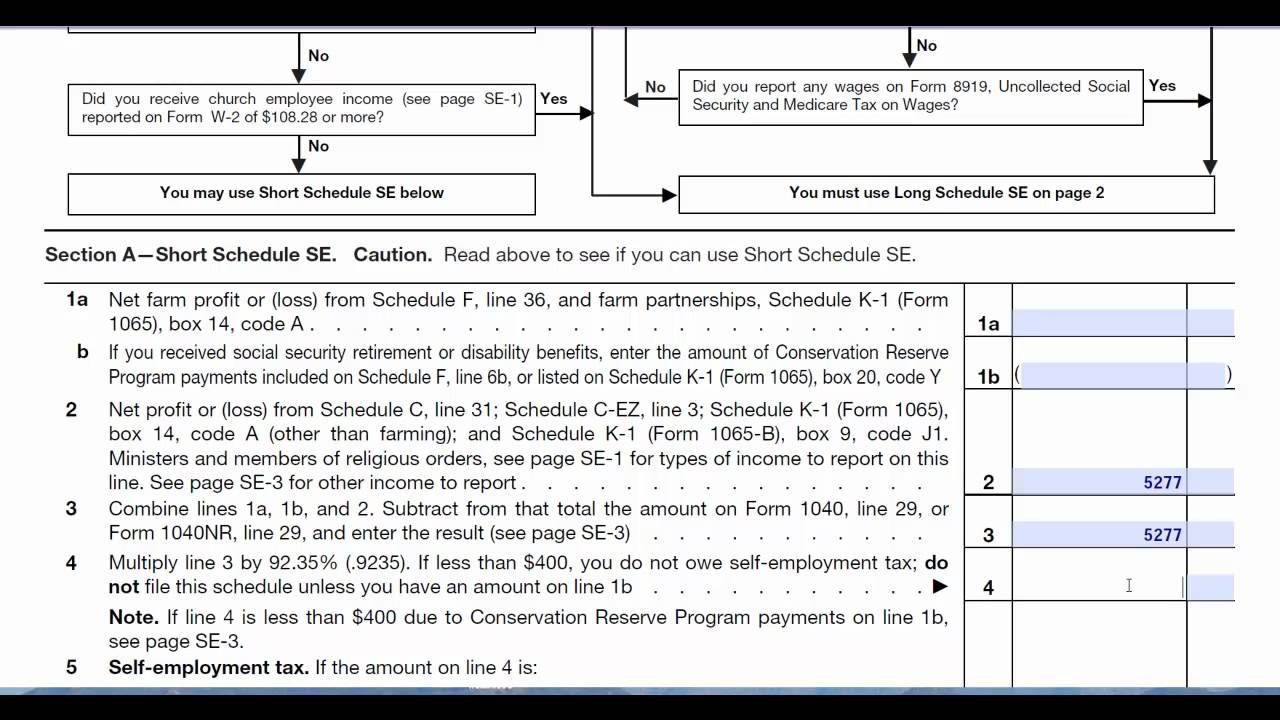

Source : m.youtube.com2012 Form IRS 1040 Schedule SE Fill Online, Printable, Fillable

Source : www.pdffiller.comForm 1040 Schedule Se 2024 Download Federal Income Tax Spreadsheet Form 1040 (Excel Spreadsheet : Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . Prevent a repeat in 2024 by taking these three steps and you would fill out Form 1040, Schedule A to receive the deduction. See the IRS publication on medical and dental expenses .

]]>